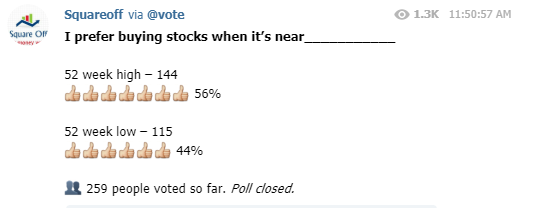

This is really an interesting question and even I have posted a similar question in ourtelegram channelto understand what the general investors/traders think about buying a stock near its 52 week range.

As you can see, though 56% prefer buying stocks near 52 week high, still its not a major percentage. It’s almost 50–50, half of them believe buying at 52 week high is good and remaining believe its buying at 52 week low that works well.

There are multiple research papers published regarding the traders/investors behavior when stock price reaches certain levels.

So I decided to make a quantitative analysis to find out what is the actual impact on buying a stock near its52 week high vs 52 week low.

Rules of Game:

- Buy the stock at 52 week high and exit from it if the stock hits 52 week low.

- Buy the stock at 52 week low and exit from it if it hits 52 week high.

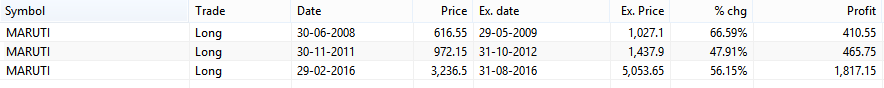

Let’s consider scenario one. Take example of Maruti stock price. From 2003 to 2018, it has given signal just 4 times.

It has easily delivered 100%+ returns multiple times.

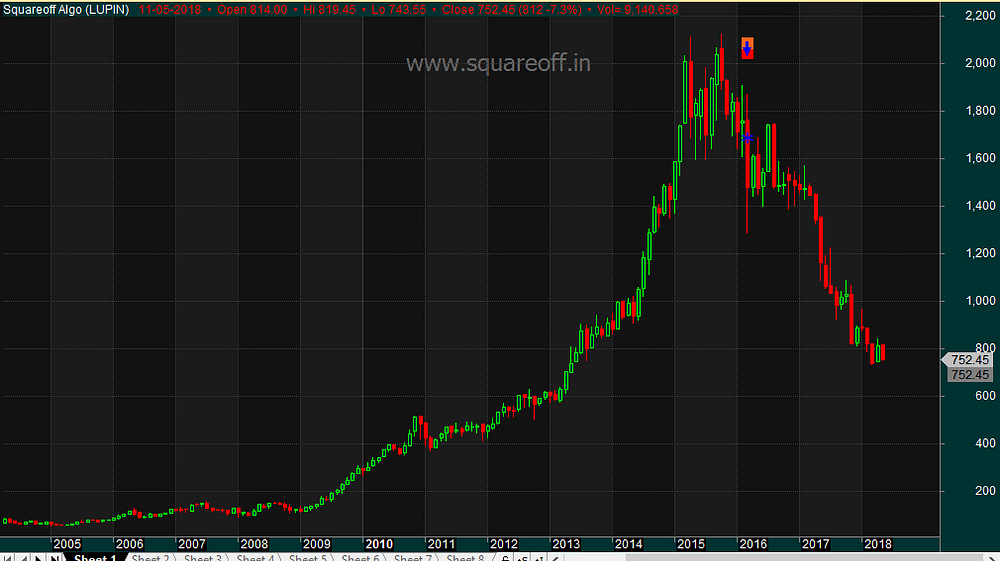

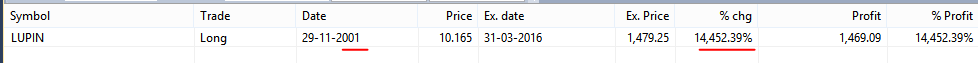

If we have used the same principle ofBuy the stock at 52 week high and exit from it if the stock hits 52 week lowfor Pharma stocks like Lupin, you would have actually ended up capturing multi bagger and exiting from it at the right time.

Lupin gave buy entry in the year 2001 and for next 15 years it has never touched 52 week low. And when the downtrend began for Pharma stocks, it gave the exit signal at the right time. And the return was mind blowing 14500% in just one trade.

So therule number 1not only helps you make higher returns, it helps you to make the exit at the right time.

What if we followed the second rule ofBuy the stock at 52 week low and exit from it if it hits 52 week high.

People who thought Lupin available at attractive price and bought when it first touched 52 week low on March 2016, its down 50% now.

But you would still make decent returns as well sometimes, check the case with Maruti if you followed rule number 2.

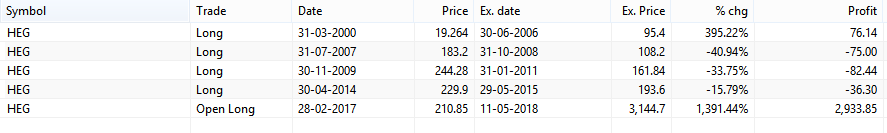

Let’s consider recent hot stocks likeHEG,even though 3 out of 5 trades are negative, still the over all gains is more than 1700%+ returns if rule 1 is followed.

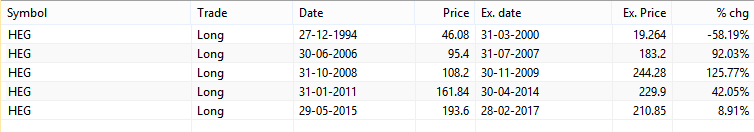

If rule 2 is followed, we end up 4 out of 5 trades profitable but still look at the over all returns, lot lesser.

Basically,

the rule number oneBuy the stock at 52 week high and exit from it if the stock hits 52 week lowis like riding the trend. You would be making highest return as long as we ride the trend.

the rule number twoBuy the stock at 52 week low and exit from it if it hits 52 week highis like mean reversion. You would be making limited return when the stock reverses from low and starts going up. But remember you have to through lot of pain in this scenario(like Lupin, SunPharma), as the stock would keep going down and we would not know when the recovery happens.

For more such analysis and stock market articles, follow us at ourTelegram Channelandblog.

If you liked this article, please do share share it (Whatsapp,Twitter) with other Traders/Investors.